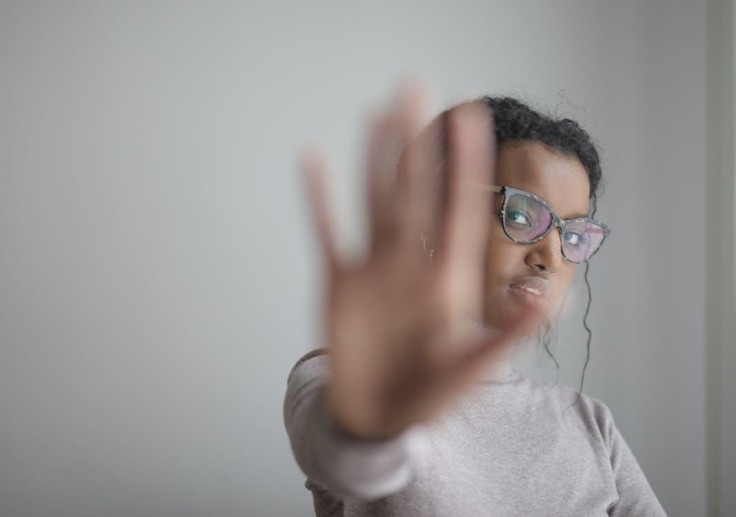

Have you ever been denied a line of credit when you needed it most? If so, this question alone can drudge up bad memories. Rejection can make anyone feel self-conscious, but when it happens to you, it's easy to convince yourself that you're only one who can't get a line of credit.

That's just embarrassment talking. In reality, 53 percent of Americans are denied credit according to a YouGov survey. The reasons why so many people face rejection vary, so let's go over some of the most common ones below.

1. Your Age

Your exact age isn't important, provided you're the legal age to contract. In the U.S., that tends to be 18 years old. If you're younger than this, you may find it difficult to find approval on your own.

You might find more success if you apply with someone, like a parent, as your cosigner. Cosigners pledge their financial good name to back your contract, so financial institutions have some security.

2. Your Location

Some financial institutions provide line of credit loans on a national scale. Others service individual states where they hold a lending license.

If you end up applying to one of these smaller financial institutions and you don't live in a state where they grant funds, you may be rejected simply because of your home address.

Remember this rule even if you hit the web for an online personal line of credit. Although anyone with an Internet connection may view a financial institution's website, only those who live in the states where they offer line of credit loans can apply.

3. Your Credit Score

Bad or thin credit score may be to blame for your latest rejection. Plenty of financial institutions check this score before they grant you funds to see if you'll handle their line of credit responsibly.

Bad credit shows you've mishandled loans or line of credit loans in the past, and it suggests these troubles may continue in the future.

Thin credit happens when you don't have an active account or recent credit history to your name. In this situation, approval is even dicier. According to CNBC, one in four Americans who don't already have a credit card are rejected because of thin credit.

4. You Don't Have a Job

At a time when unemployment is on the rise, it's frustrating to note that your job situation has an impact on your application. Sometimes, the very reason you need a line of credit is that you've lost wages or your job entirely. Many financial institutions require you to have a regular, consistent form of income, as this indicates you'll repay what you use.

Fortunately, other financial institutions are willing to accept alternative income in place of regular employment, so you may be able to use disability income, pension income, or alimony instead. Cosigner line of credit loans are another option that might work for you.

Bottom Line

There may be many reasons why you didn't get approved, but one thing is for sure: the decision isn't personal. A rejection notice simply means you don't match the black and white of a financial institution's requirements.

The next time you face rejection, find out what these requirements are. If you don't meet them, keep searching until you find an option that better aligns with your financial profile.