The Internal Revenue Services (IRS) has issued a warning to parents about child tax credit scams instigated by thieves who may use the payments to bait clueless victims.

In a statement on the IRS site, the agency told parents that they would never initiate contact with individuals to request their financial or personal detail. The IRS said they do not get in touch with the taxpayer via text, email, or social media. If a person receives IRS communications through text, email, or social media, they must report these activities to the agency.

The IRS makes phone calls to taxpayers but never through pre-recorded messages. An IRS representative will not leave a voice mail informing people a warrant could be issued for their arrest if they don't give out their information.

The scammers will allegedly fool the victims into providing more information before receiving their child tax credit payments. Worse, some of these scammers would request payments through wire transfer, cryptocurrency, or gift cards, or they would ask people to click on website links that look legitimate but may lead to identity theft or tax fraud.

No Further Action Needed

However, the IRS reminded the public that if they filed their tax returns for 2020 or 2019, they wouldn't have to do anything else to receive the payments. Their tax returns serve as their automatic enrollment for the rollout, and they may check for their eligibility by looking through the Advance Child Tax Credit Payments in 2021 program on the IRS official site.

On the other hand, non-filers who still do not have their information on file with the IRS can be eligible for child tax credit payments if they provided details through the Child Tax Credit Non-filer Sign-up Tool.

Millions of American taxpayers received the payments last July 15. The IRS said 86 percent of taxpayers opted to get their child tax credit payments through their nominated bank account. The rest got their paper checks in the mail.

Mom Lafleur Duncan of Brooklyn said that the money came at the right time as she used these to buy new clothes for her 13-year-old son. The rest of the money will pay the rent as Duncan and her husband have been out of jobs due to the pandemic.

However, Laurynn Vaughn said she had not received her payment yet despite filing her 2020 and 2019 tax returns. The mother, who has two young girls under five years old, said her payment is still pending upon checking the IRS online portal. If her payment does not come through, Vaughn can make a lump sum claim when she files for her 2021 tax return this April.

Issues with Child Tax Credit Payments

Per the IRS, taxpayers with issues, such as Vaugh, can always verify, update or make changes to their child tax credit payments using the IRS online portal. Some parents can still sign up and receive their credit in larger payments to catch up to the amount missed if they update their profiles on the portal.

However, taxpayers may also opt-out of the monthly payment scheme and, instead, collect this in one shot during next year's tax season. The portal also guides what taxpayers must do if they have an error in their payment.

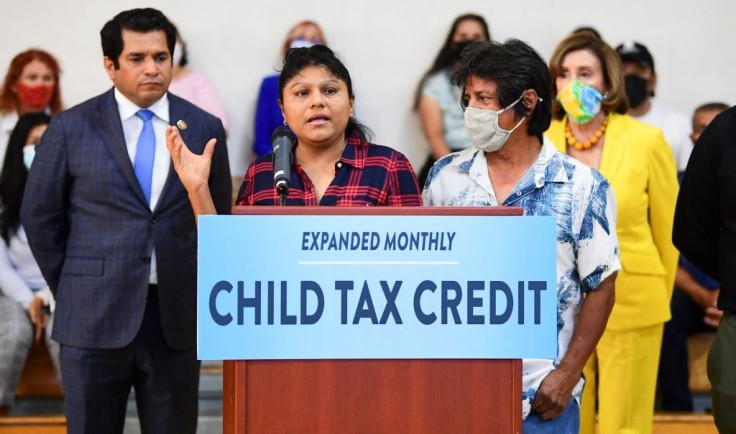

Meanwhile, there are initiatives in Congress to make this program a permanent benefit for the American taxpayers. Currently, the expanded child tax credit scheme covers the 2021 financial year only.