Parents in the U.S. are spending a record amount of money on school supplies for the 2021 school year, and some are said to be going into debt to buy what their kids need despite having two child tax credit payments.

According to the National Retail Federation, parents are expected to spend at least $850 per child on school supplies in 2021, seven percent higher than 2020's spending. Due to another year of uncertainty, moms and dads are also buying additional supplies of Clorox wipes, alcohol, and hand sanitizers on top of the basic school needs like notebooks, pencils, pens, and crayons. Preparing for a potential hybrid class also pads up the expenses as parents have to buy electronic gadgets and office chairs for their children's online classes and lunch boxes or school bags if they shift to in-person sessions.

A survey conducted by LendingTree among 1,000 parents showed that a third of the respondents expect that they will sink into more debts after buying their kids' school supplies. Apart from the pandemic preparations, parents have observed that prices of school supplies have marked up.

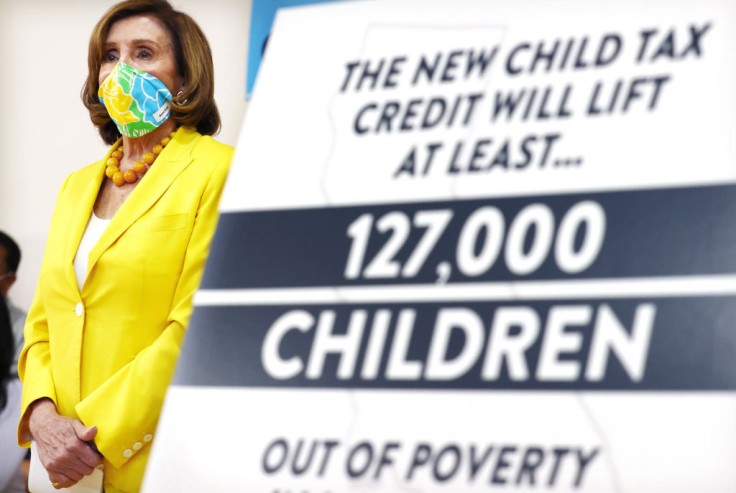

Matthew Schulz, the chief analyst of LendingTree, said that he was surprised that some parents believe they will have more debts even after the U.S. rolled out its landmark Child Tax Credit Scheme. Most parents who are eligible for the credit stand to receive $300 per child for July to December 2021.

"It just shows you how close to the margins so many people are living," Schulz told CBS News.

Financial Anxiety Reduced

However, another survey conducted by ParentsTogether Action revealed that the first child tax credit payment deposited by the IRS to the parents' account in July eased the financial anxieties of at least 56 percent of American families. Some 40 percent of the survey's respondents, on the other hand, said that the child tax credit benefit had helped their budget.

Most parents said they used the money for food purchases or groceries, childcare expenses, school supplies, and household bills. The IRS noted that the second payment in August provided benefits for 61 million kids as 1.6 million more parents signed up for the scheme.

Parents who have yet to enroll can still receive their eligible payments if they sign up at the IRS Portal, as the child tax credit payments are currently applicable for the 2021-2022 tax year. There are plans to extend the benefit into the next tax year, but this will still go through deliberation in Congress.

Student Loan Debts Cancelled for Some Borrowers

Meanwhile, college expenses remain a top concern for many parents and kids who are graduating high school this year. Among 4,000 recent graduates surveyed by Fidelity Investments, 4 in 10 said college tuition has become more expensive, forcing their parents to pay in installments. Others rely on scholarships, grants, and student loans.

As generations continue to be burdened by student loan debts despite the moratorium on payments in 2020, the Biden administration announced the cancellation of $5.8 billion student loan debts for borrowers with permanent disabilities.

Education Secretary Miguel Cardona said that this comprises over 320,000 borrowers who will automatically qualify for the loan forgiveness through their Social Security Administration data. The process will start this October.

Related Article: Back-to-School Season: Parents Told to Prepare for Rising Costs