New data from Children's HealthWatch, a nonpartisan group of health care workers and researchers, showed that food insufficiency among American families with children increased by 12 percent in the month of February after child tax credit payments under a federal Covid-19 relief plan expired.

Food insufficiency had dropped by 26 percent last year, when more than 36 million families in the United States received the child tax credit payments. Those payments, however, stopped in December of last year after Congress defeated the Build Back Better legislation that would have made them permanent.

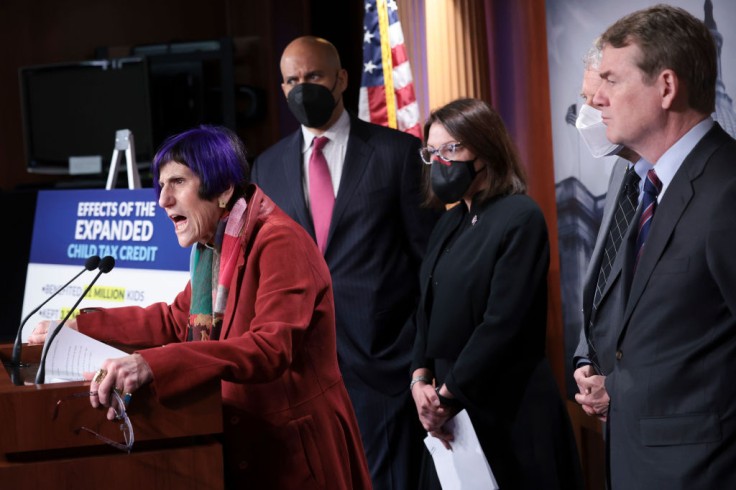

The expanded child tax credit, which is part of the American Rescue Plan Act of 2021, provided qualifying families $250 to $300 per child each month. Allison Bovell-Ammon, who is the director of policy strategy at Children's HealthWatch, told NBC News that the significant reduction in food insecurity really speaks to the fact that people were using the child tax credit payments to afford basic needs.

Children's HealthWatch found wide disparities in recipients of payments

Children's HealthWatch also found wide disparities in who received the payments. According to the organization, families without active bank accounts were less likely to receive payments than those with an active account, and families in which the mother was an immigrant were less likely to get the credit than those with mothers who were born in the United States.

Bovell-Ammon said recently that there is a lot of fear around accessing government programs across the board among the immigrant community in particular. She added that there is also a huge information gap, with information potentially not being available in multiple languages and in communities by trusted community members where people live.

According to ABC Action News, the organization is now urging the U.S. government to restart child tax credit payments to help families afford food. Kristen Olsen is one of those mothers who is affected by the cutoff. She is raising the youngest of her three sons, George, as a single mother in the state of West Virginia.

Senator Joe Manchin feels the heat in West Virginia

Olsen buys fruits and vegetables only when they are on sale at the grocery store. She mostly buys rice, beans, potatoes and sardines instead, which she packs for lunch at work every day. Olsen went to a food pantry last winter for the first time and she has been taking advantage of clothing giveaways in her neighborhood.

The double whammy of having to pay more for gas, utilities, and rent because of inflation and losing the expanded child tax credit left Olsen searching for new ways to support her family. In West Virginia, 93 percent of children in the state qualified for the child tax credit.

Senator Joe Manchin of West Virginia was the lone Democrat who did not support the Build Back Better proposal of the Biden administration, which would have made the extended child tax credit permanent. Manchin told the Business Insider that he considered it a disincentive to work.