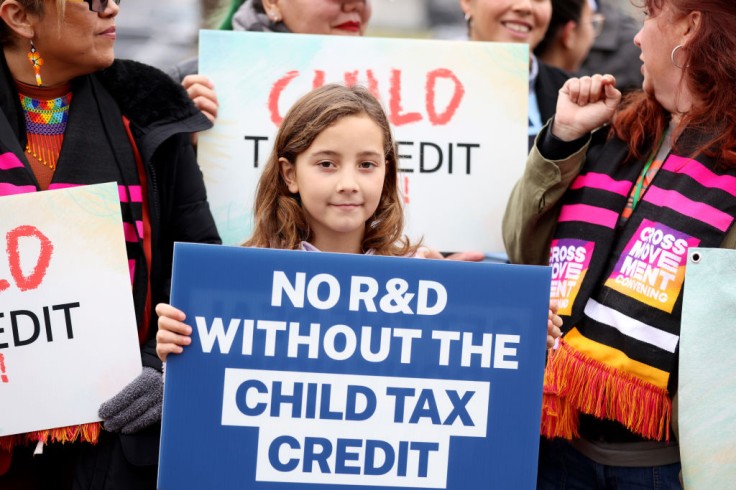

Congress is on the verge of finalizing a landmark $70 billion bipartisan tax-break agreement. This bipartisan effort, a collaboration between the Senate and the House, focuses on two key objectives: a notable expansion of the child tax credit and the introduction of substantial tax incentives for businesses, projected to bring transformative changes through 2025.

$70 Billion Bipartisan Tax Break Focuses on Child Tax Credit

A prospective compromise is looking promising, according to Rep. Jason Smith, R-Mo., chairman of the tax-writing Ways and Means Committee.

The chair of the Senate Finance Committee, Ron Wyden, a Democrat from Oregon, stated that he has been working on the tax deal for the past 18 months and that he hopes to finish it by January 29. He added that they are focusing on a very specific goal, which is to finish this in time for the filing season, and said that they are very close to it.

The package, which is being negotiated by members of the Democratic-led Senate Finance Committee and the Republican-led House Ways and Means Committee, is split evenly between the Democrats' main demand, enhancing the child tax credit, which drastically cuts childhood poverty, and providing new tax incentives favored by business, which Republicans are seeking in exchange.

The emerging deal, which remains fluid, aims to provide targeted relief for needy families and multi-child families. It would boost refundable child tax credits and incrementally lift the $1,600 cap on refundable credits. It would also give tax filers the option to use previous years' incomes if that enables their access to larger benefits.

By adjusting the credit structure, the plan aims to provide more substantial support to needy and multi-child families. This initiative, however, stops short of reinstating the monthly child cash payments that marked 2021's approach to child welfare.

Read Also: Missing 61-Year-Old Man With Schizophrenia Found 3 Weeks After St. Louis Nursing Home Closure

Introducing Business Incentives to the Tax Break

Balancing the scales, the Republican-led House Ways and Means Committee has successfully negotiated the incorporation of business incentives into the tax break. These incentives are seen as a revival of certain aspects of the Trump-era tax cuts from 2017.

Key features include full expensing for domestic research and development, reinstatement of the pre-2017 interest deduction, extension of bonus depreciation, and the expansion of small-business expensing.

These measures are anticipated to inject vitality into the business sector, encouraging growth and innovation within the domestic economic framework.

Sen. Mike Crapo, a Republican from Idaho and the ranking member of the Finance Committee, stated that he is very committed to trying to get a resolution on the tax policies as it is of utmost significance.

Crapo has indicated that the negotiations will include modifications to the child tax credit as well as company tax credits; however, he has declined to provide any further specifics.

The negotiations, while intricate and ongoing, reflect a concerted effort to bridge political divides for the broader benefit of the nation. The nearing completion of the $70 billion bipartisan tax break marks a significant milestone in congressional negotiations.

By balancing enhancements to the child tax credit with the introduction of business incentives, this deal could set a precedent for future bipartisan efforts.