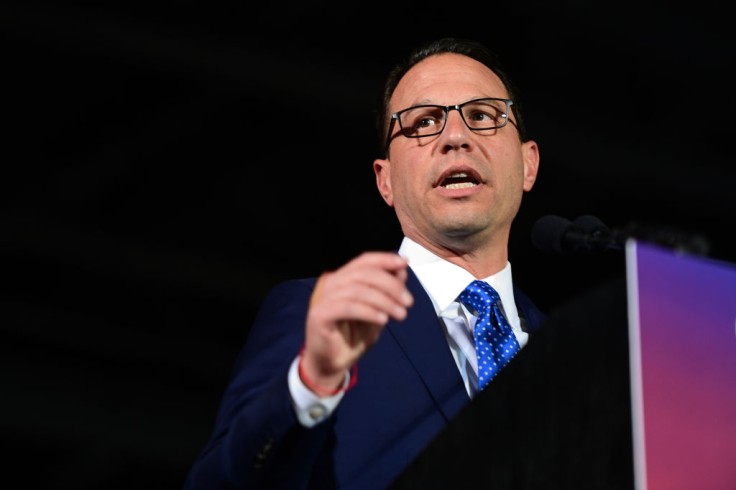

Pennsylvania extends property tax rebates to its senior constituents. Governor Josh Shapiro continues to roll out the program meant to alleviate the burden on seniors in Pennsylvania through a property tax or rent rebate to alleviate the high cost of living.

The said government program was set to expire on June 30; however, Shapiro extended the deadline to December 31, 2024. This extension provides seniors additional time to claim up to $1,000, a significant increase from the previous year's maximum rebate of $650.

Application for Senior Rent Rebate Increases

The program, funded by the Pennsylvania Lottery and gaming revenues, aims to support both renters and property owners over the age of 65, widows and widowers aged 50 and older, and adults with disabilities.

With a household income cap of $45,000 per year, this rebate targets some of the state's most vulnerable residents.

Applications can be submitted online via the mypath.pa.gov website, where applicants must provide proof of age, disability, income, and property taxes or rent paid.

State Revenue Secretary Pat Browne noted that the number of applications submitted this year has already reached 445,000, an increase of 100,000 compared to the same period last year.

Browne added that the application received on the registration amounts to nearly 80,000 first-time filers who will be benefiting from the rebate program for the very first time.

Encouraging Eligible Residents to Apply

Despite the increased application numbers, financial literacy expert Alex Beene from the University of Tennessee at Martin emphasized the importance of eligible residents taking advantage of the program.

Beene explained that the extension should be more of an alert to those who qualify than a sigh of relief. In order to receive the property tax/rent rebate from the program, residents first need to file to receive it. Failure to apply for other seniors will result in no benefit, regardless of the extended deadline.

The program operates on a first-come, first-served basis, with the rebate amounts varying based on income. Seniors earning $8,000 or less per year are eligible for the full $1,000 rebate.

Those with incomes between $8,001 and $15,000 will receive $770; those with incomes between $15,001 and $18,000 will receive $460; and those earning between $18,001 and $45,000 will get $380.

Read Also: Students Walk Out From University of Chicago Graduation Commencement After School Withholds Diplomas

Positive Impact Amid Economic Challenges

Furthermore, Kevin Thompson, a finance expert and founder/CEO of 9i Capital Group, commented on the significance of the rebate program.

Thompson commends the continuous government initiative in the state, saying the rebate provides a much-needed financial boost for lower-income seniors. He believes that even a small rebate, not only for owners but also renters, can provide seniors with a great deal of relief most especially nowadays with the ongoing inflationary pressures across the country.

The Pennsylvania Property Tax/Rent Rebate Program is a vital support mechanism for seniors, providing financial relief that can make a significant difference in their lives.

With the extended deadline, eligible residents are encouraged to apply and take full advantage of this beneficial program.

Related Article: Elderly Woman Dies After Carjacking at DC Hospital: Incident Sparks Safety Concerns