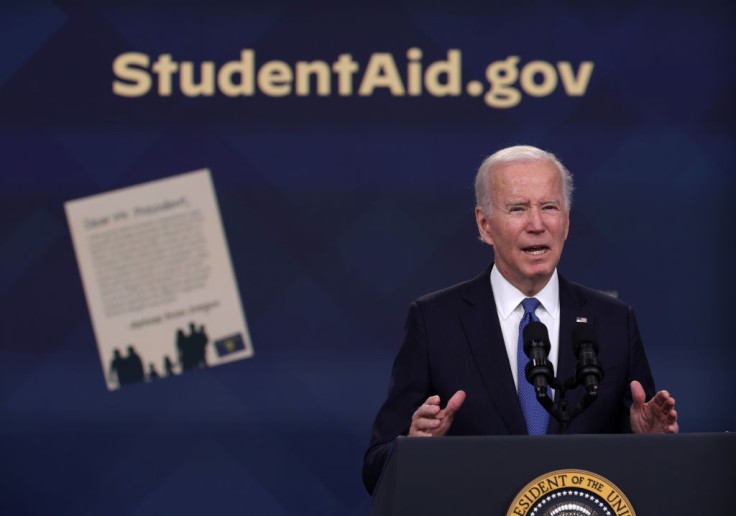

A U.S. appeals court has permitted President Joe Biden's administration to advance with an important part of a new student debt relief plan aimed at lessing monthly payments for millions of Americans.

10th Circuit Temporarily Lifts Injunction on Education Department Debt Relief

On Sunday, the 10th U.S. Circuit Court of Appeals in Denver briefly lifted a decree from a Kansas judge, which had been appealed by Republican-led states contending that the debt relief plan from the U.S. Department of Education was unlawful.

As an outcome, the Education Department declared it would persist in lessening undergraduate loan payments and instructed loan servicers to achieve the plan's changes.

U.S. Secretary of Education Miguel Cardona stated that the court's decision supported student loan borrowers benefiting from the SAVE Plan, described as the most affordable repayment plan in history. This plan allows more positive terms than former income-based compensation plans, reducing monthly payments for qualified borrowers and forgetting debt after 10 years for those with original principal balances of $12,000 or less.

On June 24, U.S. District Judge Daniel Crabtree in Wichita, Kansas, ruled that the Higher Education Act of 1965 did not allow the "unprecedented and dramatic expansion" of income-based repayment plans proposed. He sided with state attorneys general from South Carolina, Texas, and Alaska who challenged the plan, restricting only parts of the SAVE Plan that were not yet in effect.

However, in a brief to the 10th Circuit, the administration argued that Crabtree's ruling was only "technically prospective," implementing it would require reprogramming complex software, which would take months.

The U.S. Department of Justice argued that during this period, numerous borrowers in the SAVE Plan would require forbearance until their loans could be appropriately managed.

Millions Benefit from SAVE Plan, Forbearance and Interest Waivers Implemented

The Education Department noted that around 3 million borrowers would be placed into forbearance under SAVE and would not accrue interest during this period.

The White House has indicated that more than 20 million borrowers could benefit from the SAVE Plan, with 8 million already enrolled and 4.6 million having their monthly payments reduced to $0.

Although the administration sought to halt Crabtree's ruling, it did not ask for a similar delay regarding another injunction by a federal judge in Missouri that blocks additional loan forgiveness under the SAVE Plan. The administration has placed some borrowers in forbearance while legal issues are resolved.

Natalia Abrams, president of the Student Debt Crisis Center, expressed frustration with ongoing legal challenges aimed at limiting borrower relief but welcomed the Department of Education's swift action in placing 3 million borrowers in administrative forbearance.

After its implementation in the fall, around 8 million Americans enrolled in the SAVE plan, part of President Biden's broader efforts to provide relief to student loan borrowers.

In October, the plan increased the amount of income protected from 150 percent above the federal poverty guidelines to 225 percent. It also ensures that borrowers who pay their loan principal monthly are not penalized for unpaid interest growth.